We're still early, but it has started

Making moves for a cyclical capital rotation into commodities

It’s just cycles doing what cycles do. But most won’t act until it’s already played out.

For years, capital has blindly chased the same trade: growth stocks, tech, passive exposure. It worked - but the decades old strategy may be about to expire, leaving many holding bags with an unfortunate future. Under the surface, a rotation has already begun. Capital is slipping out of the high-flying names and quietly repositioning into hard assets, energy, and real-world infrastructure. Yet the crowd still clings to yesterday’s winners, “buying the dip” and doubling down on a playbook that no longer fits the environment. That disconnect? That’s the opportunity.

We’re still early.

Before I dive in, let me just say: at the time of writing, I expect some meaningful pullbacks—or at the very least, some sideways chop—in the assets and sectors I’m discussing. I’m pointing this out because I’d rather leave the trend-chasing to the mainstream media and focus on the opportunities I see unfolding. So if we do get dips, maybe use that time to take a closer look instead of waiting for the next parabolic move upward. Or don’t. Do whatever you want.

A Generational Capital Shift Back to Commodities

We find ourselves at an intriguing crossroads in the world of macro finance and economics. For those of us keeping a pulse on market trends, it’s becoming evident that a significant capital rotation is underway, one that’s steering investments back toward the commodities sector, specifically mining and metals. This isn’t just a fleeting trend; it’s a signal of deeper currents at play. Let’s explore the long-term cycle of commodities, the historical significance of mining, the implications of dollar dynamics, the burgeoning necessity for energy minerals, and the shifting correlations shaping our market landscape.

Commodities and Their Long-Term Cycle

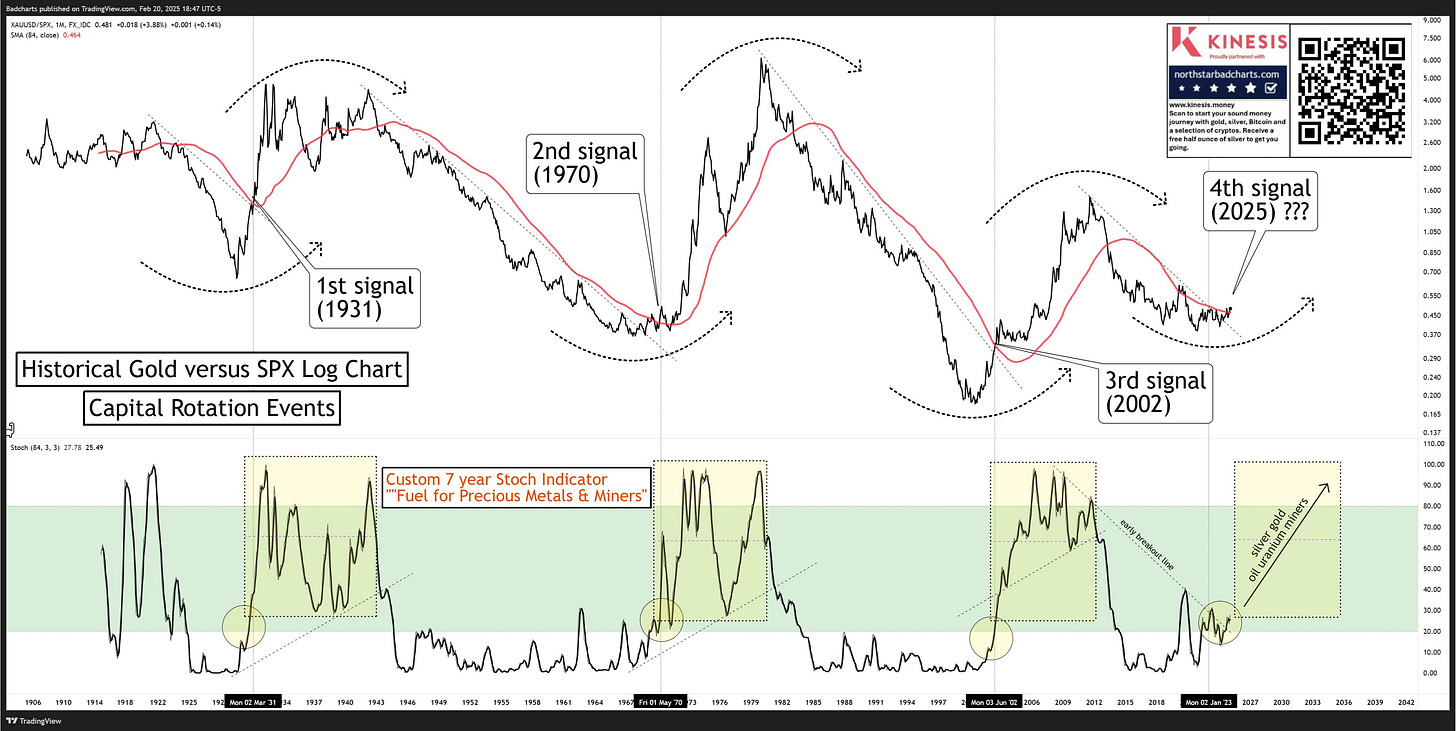

Commodities are like the tide; they ebb and flow over long periods. History has shown us that they operate in cyclical patterns driven by demand, supply, and the whims of geopolitical events. Investing in commodities often means positioning oneself for the long haul, anticipating that what goes up must come down—and vice versa. The renewed focus on this sector today suggests that some investors recognize these cycles and are preparing for a long-term play amid rising inflation and the scarcity of essential resources.

Mining’s Historical Weight in Our Economy

Let’s take a step back and consider the mining sector’s role in economic development. In the 1970s and 1980s, during high commodity price eras, natural resources (mining + energy + raw materials) often represented 15–20% of global GDP, especially when input costs dominated production. Today, that figure has plummeted to around 0.4%. This drastic decline highlights a shift in our economic priorities, favouring services and tech over resource extraction. Yet, as we navigate increasing resource demands in a world striving for sustainability, it becomes clear that reinvesting in the mining sector is key for economic rejuvenation.

The Currency Lifecycle: Peak Dollar Strength and Beyond

The dynamics of the dollar have been a rollercoaster for many years now. Bret Johnson introduced us to the intriguing "Dollar Milkshake Theory," which suggested that the dollar would secure peak strength due to global liquidity trends and being “the cleanest, dirty shirt”. And here we are, seeing signs that this peak might be fading. The dollar appears overbought, yields may have peaked, and we’re starting to see a massive awakening in the gold market. A weaker dollar typically leads to increased demand for gold, so gold may be acting as an indicator of this expectation. It should also be noted that, despite what politicians and the MSM say, a weaker dollar is actually preferred. If the dollar is inflated, debts become smaller and it encourages a more favourable trade balance. This evolving narrative around the dollar is something investors should closely monitor

Energy Minerals: Underinvestment Meets Surging Demand

Gold may be currently moving first and aggressively, but let’s talk about something else: energy minerals. A major blind spot in today’s market is the chronic underinvestment in energy minerals. While global rhetoric has fixated on a green transition and electrification, capital allocation into the critical minerals that make it possible—like uranium, lithium, copper, nickel, and rare earth elements—has lagged far behind. New mines take over a decade to develop, permitting is slow, and ESG constraints have deterred investment in extraction projects. Meanwhile, demand is compounding year over year.

This mismatch is setting the stage for a dramatic supply squeeze. As governments double down on electrification targets and the private sector races to expand battery production and grid infrastructure, we’re facing an unavoidable reality: the materials needed simply aren’t being produced fast enough. When supply can’t meet demand, prices go up—and fast. That’s where the investment opportunity lies. We're not just looking at cyclical upside; we’re staring down a structural shortage with long-term implications. For those paying attention, this is where the next commodity boom is already brewing. I’ve previously written more extensively about one such supply crunch here.

Breaking Market Correlations: Copper and the Nasdaq

An unexpected development in the current market is the disconnect between copper prices and the Nasdaq index. Traditionally, we see some correlation here; as tech stocks rise, copper does too. Yet recently, we've noticed copper prices climbing even as the Nasdaq takes a hit. This divergence isn’t just random chatter; it’s indicative of a more profound structural sentiment shift. What it suggests is that we’re entering a capital rotation phase—perhaps spurred by inflation—where investors are pivoting toward tangible assets like metals rather than sticking solely with equities. Fortunately for commodity investors, this indicates it may be a winner in all environments, outcomes.

Bitcoin and Crypto: The Barbell Between Tech and Hard Assets

While traditional commodities are seeing a renaissance, there’s another asset class worth watching—one that doesn’t fit neatly into existing categories: Bitcoin and crypto. In many ways, Bitcoin represents a new hybrid—part digital commodity, part tech innovation, part macro hedge. It doesn’t have the centuries of historical backing like gold or the industrial demand of copper, but it offers something increasingly rare: digital scarcity, decentralization, and programmable utility.

In an era of monetary debasement, Bitcoin has positioned itself as a kind of “digital gold,” appealing to those seeking an inflation hedge. Simultaneously, its technological roots give it exposure to growth narratives typically reserved for high-beta tech. This strange duality makes it a unique barbell asset—bridging the hard asset world with the exponential upside of innovation.

That said, it’s still early. Bitcoin’s short history means it hasn’t yet been fully tested across multiple economic regimes. But for investors willing to embrace calculated risk, a small allocation could serve as both an asymmetric bet on a new monetary paradigm and a hedge against systemic uncertainty.

A Repricing of What Matters

This shift back toward commodities isn’t just a market anomaly—it’s a repricing of what truly underpins economies. For decades, capital flowed into intangible growth stories, but the tides are turning. Resource scarcity, geopolitical realignment, currency instability, and underinvestment in critical infrastructure are all converging to reignite interest in the real, the hard, and the necessary.

Mining and metals—once the backbone of global GDP—are being revalued in light of their foundational role in everything from energy transitions to technological infrastructure. Meanwhile, newer assets like Bitcoin blur the lines, offering potential as both innovation and insurance.

We’re not just rotating capital. We’re rethinking what we value.

This is a moment for forward-looking investors to act with intention. The opportunities may be cyclical, but the implications are generational.

Where I'm Placing My Bets

With capital rotating and hard assets coming back into focus, the key isn’t just to be in commodities—it’s to be selectively positioned in vehicles that preserve purchasing power, generate income, and offer asymmetric upside. Here’s where I’m putting my attention:

Kinesis Money (kinesis.money)

My favourite play in this space. It combines the stability of physical gold with a built-in yield mechanism. In a world where yield is often tied to counter-party risk, earning income on vaulted metals is a rare and powerful proposition. This is one of the few places where you can protect purchasing power and get paid in gold to wait. It’s the my favourite place to park capital by far. You can read more in my primer, here.Open a Kinesis.money account here and we both get a 1/2 ounce of silver for free.

Physical Precious Metals (Self-Custody)

This is your tinfoil-hat, libertarian insurance policy—and I say that with full respect. When trust in institutions erodes and the fiat experiment creaks, having physical gold and silver in your own hands becomes less fringe and more fundamental. Not for trading, but for sleeping well and handing down to your kids.Agnico Eagle (AEM)

A cash machine in the gold space. If the metal keeps rising, Agnico will likely keep printing. That said, it’s had a sharp run and the spotlight is firmly on it now. For those looking to enter, patience may pay—buying dips rather than chasing momentum is the move here. This is the Nvidia of gold mining.Heliostar Metals (HSTR.V)

This is the value investor’s pick in the junior space. Undervalued relative to what they’ve got in the ground, and largely flying under the radar. It’s a higher-risk play, but one with real geological backing—and in a sector where discoveries still move the needle, that counts.Bitcoin

A cautious but necessary allocation. Bitcoin straddles multiple narratives—digital gold, inflation hedge, parallel system. It’s volatile, speculative, and still unproven across full market cycles. But in a world drifting toward monetary experimentation, having some exposure makes sense.Royalty and Streaming Companies

If you want exposure to mining without betting on execution risk, royalties are the way in. These companies sit upstream of the drama, collecting checks whether mines run into delays or not. They’re low-operational-risk vehicles with strong margins and leverage to rising commodity prices.Denison Mines (DNN)

Uranium is (still) setting up for a major supply/demand crunch, and Denison is one of the better-positioned names in the space. Well-managed, with solid assets. But as with Agnico, the trade is getting crowded—hot money is here. Wait for shakeouts to build a position. I’ve been in this trade since 2018, waiting for the big move, I don’t know if that’s a good thing or a bad thing. I do know that if we hope to meet any of our electrification targets or are even remotely serious about reducing carbon emissions, nuclear energy as a base-load energy source is absolutely critical. There is no other clean energy source that even comes close to the energy return on energy as with nuclear. You can read more about my thoughts on nuclear energy here.

Silver

Silver has been a core part of my positioning since 2018 as well, largely on the thesis of a mean reversion in the gold-to-silver ratio. That ratio has historically pointed to silver being undervalued—but I’ll admit, my conviction in that metric has started to waver. After all, we don’t apply a “natural occurrence” ratio to other metals, so why should silver be any different? That said, I’m still on board. Silver has a habit of spiking aggressively at the tail end of major gold moves, and we haven’t seen that yet. It’s volatile, emotional, and often irrational—but that’s why I like it. Just don’t mistake it for a steady trade. Silver demands timing, patience, and a strong stomach.

Honourable Mention: B2Gold (BTG)

B2Gold should be tracking closer with Agnico given its quality and production profile, but it’s lagged. That disconnect might be something I’m missing, a short-term inefficiency—or an opportunity. Worth keeping an eye on for mean reversion.

Please note that the Kinesis link is an affiliate link and I could change my mind on any of the above picks tomorrow without notice. It is imperative that you do your own due diligence before deploying any capital into any asset. I’m just writing on what I’m passionate about because I enjoy it and I hope you enjoy it enough to take a closer look as well.

<3

Derek